First Time Investor Webinar

How To Invest In Real Estate Without Huge Wads Of Cash

Are you a First Time Investor? Do you have lots of dreams but not a lot of cash?

We published a Real Estate Investment Strategy Guide, but it isn’t very helpful for the First Time Investor.

We found an excellent expert and teacher to help you understand exactly how and why you can start investing and building your real estate investment empire.

Find out how this bright young man turned a modest investment into a portfolio of 100+ rental units in just ten short years!

VIDEO TRANSCRIPT

Kendyl: Hello everybody. My name is Kendyl and I am the owner broker of DIGGS. And as we like to say, we connect cool people with cool homes in Glendale, La Canada and LA Crescenta. But many of you have already achieved your first home and you’re thinking, wow, wouldn’t it be great to start my real estate empire? But you remembered how hard it was to actually save up enough money for your first house and now you’re paying a mortgage and you’re wondering, Oh, will I ever be able to get a piece of investment property? I know how you feel. And I was actually at a Provisors meeting that’s a networking group of really high level, uh, practitioners in all kinds of professions. And I met, uh, Anthony and Cody at the Buckingham investments seminar where they were talking about how they teach first time investors how to start their real estate empire and trade their way up to having real wealth and income and passive income that will take them well into their retirement years and beyond. So I asked Anthony to do this presentation for my agents to teach them how to help people. And it was so good we decided to make this webinar to get this information out to the entire DIGGS tribe. So Anthony, thank you so much for coming on to our little webinars series.

Anthony: Absolutely. Happy to be here.

Kendyl: We were so impressed with the information that you had. Um, I’m just gonna pretty much let you dive into it. Please drop some wisdom and knowledge on our people and let’s get those empires started.

Anthony: Absolutely. Thanks Kendyl. Okay, so, uh, my name’s Anthony Walker. I am the CEO and managing broker of Buckingham investments. We are a local Southern California multifamily brokerage firm in our little niches and helping people learn all about how to invest in real estate, specifically multifamily property, right investment plan that can deliver on your future goals. And then when our clients are ready, we help them get out there and invest and buy their first property or scale up if that’s what they’re trying to do. So today I’ll just purely to go over an initial presentation that covers a lot of our strategy and our philosophy and sort of the numbers behind this at a really high level. And if that’s something that speaks to you, then have tons more information for you as well. So first of all,

Kendyl: interrupt you real, real quick. Just in case you’re thinking, Oh my God, I don’t have $500,000 to drop on an apartment building. I’m just a first time investor, Just stay tuned. Anthony has some great news for you guys. Okay, keep going. Sorry.

Anthony: Ultimately you don’t have to already be rich to do this. However, there’s this quote attributed to Andrew Carnegie that goes something like 90 of all millionaires became so through owning real estate. And that absolutely remains true today. Uh, we were just talking at lunch here at my office about an article in the LA business journal that came out in a recent edition of it had the top 50 wealthiest Angelenos. And I think if you went through the list of 50, probably easy, 80 90% of those people were in the real estate business somehow. So it’s the most tried and true way to true wealth in our country and it’s surprisingly easy to get in. And the most important thing is that you just start. That’s it. And a lot of people are really worried about how to start so we can help there. So I’m also an investor myself.

Anthony: We’re not just brokers here. We all at Buckingham investments practice what we preach and we all invest in real estate ourselves. So what we have right here is just a little bit of a personal story of mine. This is my very first time investor – a multifamily property purchase. This was a little duplex down in long beach with a a nonconforming unit out the back, right. Then we, Tommy as well. I bought this about 10 years ago and held onto it for a while. Actually. Looks pretty good in this picture, but it was this kind of a beat up property, but this is what I could afford and pay for itself, held onto it, exchanged it into this one. This is a five unit apartment building in the same area. It’s both of these, these buildings, the front one in the back one also. Not a whole lot to look at, but it did its thing.

Anthony: Cashflow for me on it for a while and then exchange that into this guy, which now we’re starting to look a little bit more serious. Right. This is more what you think of when it goes apartment building. So this is an eight unit building also long beach. Uh, we do a lot of business in long beach. It’s a great market for this type of stuff that really all over LA has got great apartment buildings that you can invest in on a pretty small scale. Um, since I bought this one I’ve sent, you know, refinanced it and bought other properties and exchanged other properties into other properties. And now I have a sizeable portfolio of units spread through a number of buildings, probably around a hundred units, mostly in long beach. And they paid most of my six expenses in my life. So I’m fortunate enough to be able to help other people learn how to do this stuff.

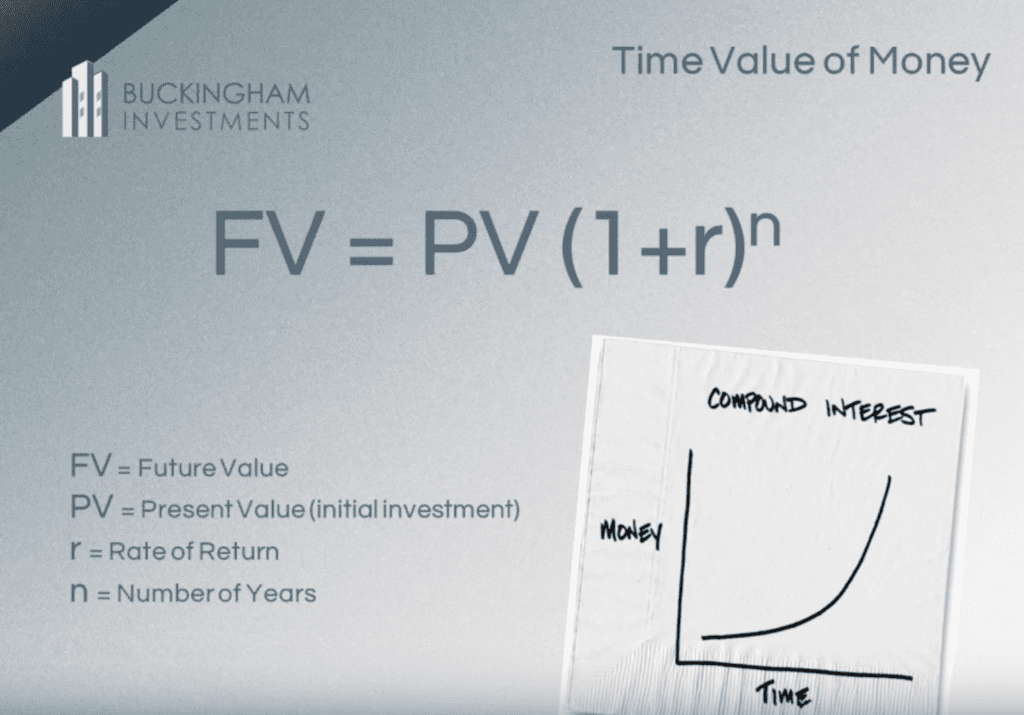

Anthony: And I don’t have to have this stress wondering if I’m going to be able to make the mortgage payment on my house every month. So how did I get here? Right. Well real estate investing at the end of the day is investing like anything else. So if you start as a first time investor, at the very beginning, a lot of us never took a finance class because they don’t teach that in high school. And if you didn’t take business in college, you probably never learned this stuff. Well, um, all investing really boils down to what’s called the time value of money equation or the compound interest formula. And that’s what we have right here in front of you. It looks overwhelming at first, looks like a lot. It’s really not that complicated. This is the equation that works in any investments that you could make. It compounds upon itself. So this applies to money in a savings account or mutual funds or stock market or real estate or anything like that.

Anthony: And the variables go something like this. It says the future value of the sum invested today, which is your present value is equal to that present value. That initial investment multiplied by one plus the rate of return you’re able to achieve on the investment to the power of N whereN is the number of years your investment compounds. Now that sounds kind of complicated at the beginning, but if we graph it out like we have right here on this little cocktail napkin, you can get the idea. So if we put money on the Y axis here and we put a time on the X axis and your initial investment is that any equals zero or time equals zero as time goes on and your investment returns and compounds upon itself and your money makes money for itself, then the slope of this line accelerates over time.

Anthony: And that’s the magic of the compound interest formula here is that as long as you have your money working for you, then you’re going to make more and more and more every year. Even if that’s just in a savings account or something, you’re still taking advantage of that effect. Now the difference between putting your money into like say a savings account versus a real estate investment is the rate of return or even glued achieve is what determines how quickly this line accelerates. So money in a savings account mates might go away off of this page and start to slowly accelerate as you have your money in there for a couple hundred years. But that’s not a very useful way for most of us to get rich because we’re probably not going to live that long. Uh, first time real estate investing has a unique ability to provide a really strong return over a long period of time, even with pretty conservative assumptions.

Anthony: So we see a curve that looks something like this. Now maybe this function makes a little more sense into a word problem. If we put it into a word problem, that’s actually become what most of our frist time investors use as a general investment plan. So this is the beginning of your plan and it goes like this. I’m going to invest present value dollars for any years in real estate investments at a sustained rate of return of our percent. And I’ll be worse. Future value dollars at the end of the plan. So now this starts to make a little bit more sense, right? And if you look at the four variables in this equation, we actually know some of them already. We know present value when we’re starting off because we only have a limited amount of funds to use. So we can plug that in here and our in our first space a for an years in real estate investments.

Anthony: So that’s up to you to decide how will, how long you’re willing to wait to be worth, how much the future value at the end of your planet. And you can manipulate those numbers as much as you want using a financial calculator. There’s lots of free financial calculators you can find online. There’s pretty good, easy to use free apps on your smartphone that you can download and you can mess around with this equation a little bit and that can get you really excited about this. Matt and I always joke that math wasn’t that exciting to me and somebody put a dollar sign in front of it and business school and then all of a sudden there was no interest. So if we just look at this on a table, this is just that equation represented on a table. And so this is just how this equation was.

Anthony: Look with that money being invested in any investment at these rates of return. And so we’ve got a few different samples, present value numbers down the left side we have a few different numbers of and for number of years that your investment might compound. And then the matrix here in the middle is what that future value of your, some invested today would be worth at these three different sample rates of return. Now you’ll notice that your rate of return on this table starts at 20% that sounds ridiculous to a lot of people that have looked at other types of investments. Maybe that’s hard to achieve, but I think we’ll look and see that you know here in real estate it’s actually not that hard to do that at all. So as a little example, if we invested $100,000 for 10 years and we were able to get a return on equity of 25% we can just follow that down to where this intersects in our matrix.

Anthony: Your, your future value will be $931,000 that’s a pretty safe assumption that you can make about a 5% passive cash return on your equity at any given point in your real estate portfolios life. So by that point in time, you should be able to make about 45 $47,000 annual spendable money, passive cashflow after investing for 10 years with a hundred grand, that’s pretty good. But it’s not really gonna do it for most people’s retirement. So look what happens as we hold that investment for a little bit longer. It only five more years from 10 to 15 years. The value of our investment goes from 931,000 to two point $8 million. So it triples in the next five years. And the reason that that’s happening is again, the shape of this graph right here. You’re seeing it start to turn vertical because your money has had more time for it to work and compound upon itself and accelerate your rate of return by the same ticket another five years later and your money is now worth eight point $6 million. So if you’ve got time on your hands and you still plan on working for awhile, this is a particularly powerful way to invest for the future. If you do the math, 8.6 million in equity could deliver $430,000 approximately in passive flow for retirement without having to sell any of the assets. That’s pretty good. I think that would do it for most people.

Speaker 4: That’d be good.

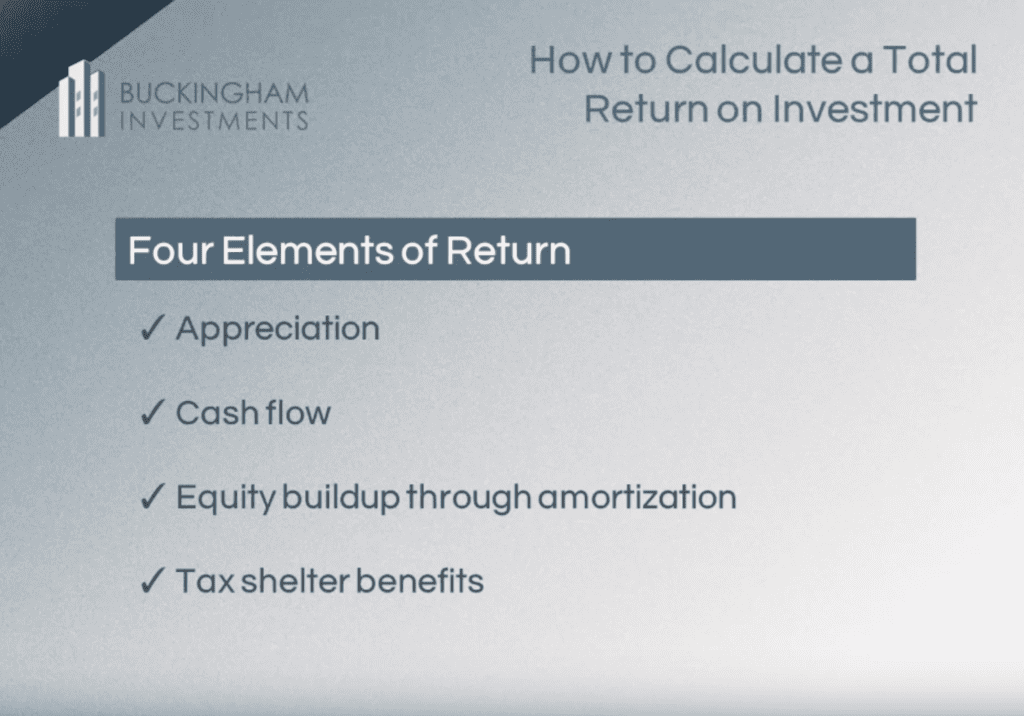

Anthony: Yeah, that’d be fine. So you can play around with the numbers on this chart. You can get a financial calculator and manipulate it yourself. Um, and we’ll kind of get into the details here now on how this works. So that our number is really what it all comes down to, the rate of return and on a real estate investment, it’s not as simple. Calculating your rate of return is not just an interest rate that you get in a savings account and it’s not just the rate that say a stock price goes up in value. There are four separate elements of return that go into that. Our number when it comes to real estate and those are in front of you right now, we have appreciation, cashflow, equity build up through amortization and tax shelter benefits. So what are all these things? Well appreciation is the increase in the property needs value over time, which then goes to equity for yourself and that’s good as area in every market we’ll look at some historical information on that.

Anthony: Cashflow is pretty self explanatory. That’s the money that comes to you to your pocket after paying for your expenses, your mortgage and everything. So that’s spendable income. That’s an important number for a lot of people. Like when you build up through amortization, it’s a mouthful but a that is actually just the principal pay down on your loan. Most first time investors buy properties with a mortgage and if your tenants are paying your mortgage for you, which they should be, then part of that mortgage payment goes to paying down the principal balance of the loan. And so when you eventually sell or refinance that property, then the that pay down on the principal is equity for you and it can be exchanged into another property or you can take it out in the form of refinance or if you just sell the property entirely, it’s yours.

Anthony: So we can express that into return because that goes to equity as your, as your mortgage paid. Then real estate is also great because you get incredible tax shelter benefits from owning. Um, you get to depreciate the value of the structure. We’re 27 and a half years with apartment buildings and you can offset that against the cashflow that the building generates. So you can shelter some of that cash flow. We can quantify those tax shelter benefits and that gets a little bit more complicated then we’ll get into today, but we can express that as a return. So looking at these numbers, I can tell you appreciation, we’ll talk about in a second as far as what percentage we can look at their cashflow tends to be in our market pretty low. It’s about three to 5% of the equity at any given point on a good stabilized portfolio, it should be at about 5%.

Anthony: That’s why I was using that number in our previous uh, analysis of the, at the time value of money table equity build up three amortization tends to be about 5% of the beginning of your amortization schedule as well. And this one is a known number. There’s no mystery there. Uh, that’s just according to the Emerson standardization schedule when you’re one them. And tax shelter benefits, you can also calculate before you even buy a property, it’s pretty simple. That tends to be three to 5% as well. So if we add all those up, you get three to 5% here, you get 5% here and you get three to 5% here. So we just take the lowest of each of those. And you can do the math in your head real quick. Three, five and three at the 11% but the charts that I showed you started at 20.

Anthony: So where are we making up the difference? Well, that’s where appreciation comes into play. So here’s 53 years of apartment building values right here in my local area, which is the greater South Bay of LA. Do you use, um, these numbers would look very similar throughout the rest of the LA area in orange County. Um, this is going all the way back to 1965 when our company first started researching and keeping track of these numbers and going through 2018 which as of right now, it’s the last school year of market data that we have. So in 1965 apartment buildings, we’re going for $14 a square foot. Amazingly, and it’s the end of 2018 we averaged 407 a square foot. So that’s quite the ride over 53 years. If we were to just average out the difference between those two numbers over this entire 63 years time period, you’d have about six and a half percent rate of appreciation going every year on the value of properties.

Anthony: And that includes recessions and booms, ups and downs, all that stuff. That’s just an average 53 year average. We’ve got about five business cycles in this chart. So if we think about it, we can use this longterm, a research to estimate the future performance of how these properties might perform as you own them. Because that’s a pretty long stack of data. So we can say that your appreciation component of return is six and a half percent. I usually use 5% just to be conservative. Now one other thing you’ll notice about this chart is we do real estate is susceptible to the occasional, you know, downturn of course, just like the economy. Um, but every time we have a little downturn in real estate values, we’d get a recovery and we always surpass the previous high where we were at before. So what that means for the first time investor is as long as you invest with a long term time horizon, as you understand that you’re going to, you’re going to be in this for a while.

Anthony: It’s pretty hard to really lose money if you stay conservative enough so you’re never forced to sell at the wrong time. That’s the key here. Even after the subprime crisis, right? We had this huge drop from 2008. We have now surpassed our previous high from 2007 and here we are in four Oh seven. There’s nothing unusual about that either by the way. The other thing you can see in this chart is, um, these real estate values are not tied necessarily one to one on how the stock market does or the economy. Um, there is a missing recession in this chart. If you know a little bit about the history of our country in economic history. You know, we’ve had a downturn in 2001 when the stock market crashed the.com bubble burst. And that was really, we kind of ignored it here in our local real estate.

Anthony: Um, internet startups lost a lot of value and people lost a lot of money in the stock market. We had the nine 11 attacks. Uh, we had a recession. Uh, but real estate kind of ignored. So, um, you know, that can happen as well. Things are sort of feeling similar to the way that they did in 2001 right now in our country. So who knows how the next, how the next cycle will look. Now that chart looks that way because of the unique characteristics that we have here in Southern California. It’s a really popular strategy right now for first time investors in California to take their money out of state somewhere in the middle of the country because everything looks cheap elsewhere. Southern California is an expensive place to be. Looks like you get more cashflow elsewhere. Looks like you can buy more for your money. And I totally understand that.

Anthony: But, uh, first time investors should understand that this chart looks like this here for a region and that this chart would not necessarily look the same way in other markets. We’re expensive here in California for a reason. And if you look at a map, that’s probably the best way to wrap your head around why that might be the case. So here’s LA. We’re surrounded by ocean on two sides, mountains to the North and a hundred miles of city to the East, basically with no real land available to build additional supply or at least a significant amount of additional supply to our housing stock. Unfortunately, that’s become a huge problem for us in the state right now and we’re trying to find a way to incentivize new construction and make affordable housing accessible to people and stop homelessness and displacement. But at the end of the day, all of those things are symptoms of geographic and economic characteristics that make this area and very powerful place to invest on the supply side of real estate, especially housing.

Anthony: Now, we’ve got an incredibly diverse economy in this area as well, so you can’t just go anywhere and say, well, it’s geographically constraints, so I’m going to buy here and it’s going to go great. It’s the combination of the demand that results from the super strong and diverse economy we have here in Southern California. And that geographical constraint. If you look around the world, you can see other markets would share similar characteristics like San Francisco, New York city, and they have similar histories, values and now pricey things are right now. We actually look relatively cheap compared to some of these other markets. If we only compare this to say the S and P 500 or something like that and they’re seeing Scott’s. I’ve turned up this article a few years ago when I did a study and you don’t have to read it all right now, but the article is basically bragging that of the original S and P 500 companies, this article was celebrating its 50th year anniversary.

Anthony: The S and P 500 who started in 1957 86 of the original companies were still in business. Now, I don’t know about you, but the chance of picking one out of 86 one of the 86 out of 500 to still be in business doesn’t sound like great odds to be if you wanted to make a 50 year investments back in 1957 on the other hand, probably every property here and every property in this list is still around. So if you ask me, this is a much more conservative way to invest your money rather than trying to pick a winner on the stock market. So now we talked about appreciation and we said a good safe assumption for appreciation is a 5% return or 5% return on the value of the property. If we go back to our core elements of return and kind of remember the numbers that we talked about a little bit, we’ve got appreciation of 5% we have cashflow is three to 5% amortization at 5% and tax shelter benefits of three to 5% we take the lowest of all those that still only 16% and again, I showed you a chart that starts at 20 so where’s the difference?

Anthony: Well, the magic in investing in real estate is you can buy these properties with other people’s money as they’d like to say. In most cases the banks have money. But when it comes to appreciation, you get to keep all of the benefits of appreciation. You’re going to put some of your own money down, you’re going to get a loan on the property as it goes up in value, the bank doesn’t get to participate in that increase in value. So here’s a simple example of how that works. We call this leveraged appreciation. And did you take one thing away from this presentation? This should be it. This is the single most powerful characteristic that investment real estate in a high demand market like Southern California than it makes it so well. So let’s look first at the left column here. Let’s pretend you have half a million dollars cash and you could just invest that without getting a loan because you were raised to believe that all debt is bad and if you could afford something, you should buy cash can’t really fault that logic, right?

Anthony: You could buy a $500,000 property and in our average year, according to the 50 year chart we looked at, if we just use a conservative estimate of 5% then that property would go up by $25,000 in your average year for appreciation. If we calculate then your return on investment or your return on equity from appreciation, that $25,000 the money you made divided by your initial investment, which is $500,000 and no surprise, that’s 5% equal to the appreciation right now. What if instead we took the same 500 grand we used as a down payment, put 25% down on a $2 million property, and we made sure that whatever $2 million property we selected generated enough rent to pay the mortgage as well as all the necessary expenses for running the property. Well, that $2 million property also goes up at 5% just like the $500,000 property, 5% of $2 million is a hundred grand.

Anthony: So in year two your first time investment property is worth 2.1 million and now the math is different. Your ROI or your ROI from appreciation is a $100,000 again, divided by your initials investment, not the purchase price, because this is what you put into the deal. So the return on your money is 20% in this example, you made $100,000 versus $25,000 on the same amount of money invested. And just from appreciation alone, only one element of return we able to make 20% that’s pretty amazing. So if we were to then go back to our four elements of return and we substitute 20% for that appreciation number, we’ve got 20% for appreciation, 3% or so for cash flow, three to 5% there, 5% for amortization, three to 5% for tax structure benefits. We’re now looking at 31% return on your money at the lowest. Now we’re on that chart. Seems crazy, but if you look at these numbers, we’re using conservative estimates, historical data, no crazy tricks, nothing fancy. This is just how the math works and people that have invested in real estate for years and become wealthy understand this stuff and the rest of us are just left to wonder how they got so rich. This is it.

Kendyl: But Anthony, how many of us first time investors have $500,000 just sitting around gathering dust?

Anthony: Ah, I’m glad you asked. Not a lot of people. Obviously that’s a lot of money.

Kendyl: Sure, sure.

Anthony: Well, the great news is you don’t mean $500,000 then the down payment to invest investment properties or apartment buildings here in Southern California. Um, in fact you, a first time investor can put as low as $50,000 down and make that work. Especially if you’re willing to owner occupy a building. You can buy apartment buildings with only three and a half percent down, which is really amazing. I mean we’ve had, we’ve had clients make this work with as little as like 20, $25,000 to invest. So if it’s a misconception that you need a ton of money to get started and apartments, you need to privately little, and I can kind of go over some general guidelines in the minute or who might be able to get started here now as far as doing the details, figuring out which property makes sense. That’s kind of where our expertise comes into play.

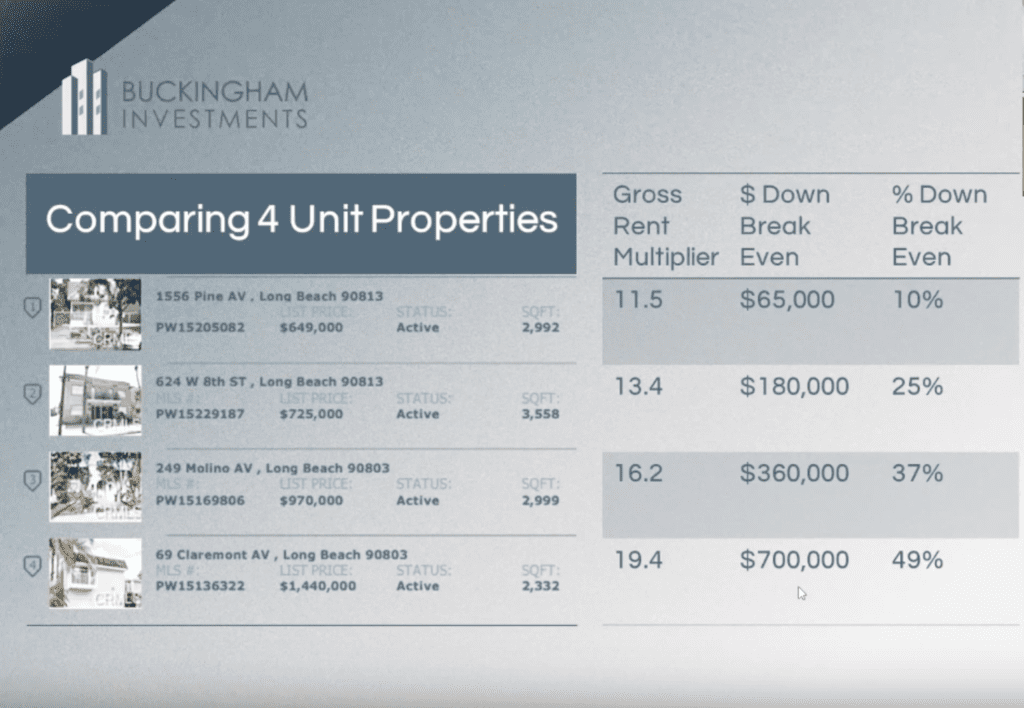

Anthony: You can’t just go buy any building and expect it to work this way because properties are very expensive here and they’re particularly expensive relative to the income that they generate here in LA. So you can’t go put 25% down on any property and have cash cashflow. Our goal is to make sure that that property pays for itself. If it doesn’t, you’re in a potentially untenable situation and you could be forced to sell that property at some point. And if that’s during a market downturn, that would be really bad. We don’t want to put first time investors into that kind of situation. So there’s some metrics that we can use to analyze deals. And this is a simple example to kind of show how that might work. So these are four different four unit buildings. This happens to be the city of long beach. This is a study that I did a number of years ago. So the prices are way off.

New Speaker: Yeah.

Anthony: And these go, these numbered buildings go in order ascending order of what most people would agree the neighborhood quality is. So number one is I’m not that great of an area. Still totally fine. Number two is just a little bit North of downtown long beach. Kind of changing a lot right now. Number three is in Alamitos beach. I’m pretty nice beach community, but it’s, you know, had a Apache history and it’s getting really nice now. Number four is so much shore, super nice, expensive part of long beach. If we look at the numbers on [inaudible] properties, there’s one, two, three, four could you just read multiplier, which is how many times the annual rent go into the purchase price? Another way of looking at it is the price you’re paying for every dollar of annual rent revenue. So the lower the gross rent multiplier, the more cashflow you would make and a property number one was that 11 and a half.

Anthony: Property number four was at 19.4 and there’s a relationship between that gross rent multiplier and what did we take to break even for a downpayment on this property? So this property that was in the least desirable neighborhood, it breaks even with 10% down. And believe it or not, at that point, this was a $650,000 property. So this would’ve worked just fine with 65,000 down for 10% whereas the Belmont shore property, because it’s at almost 20 times flows, that was going to take 50% to break even 50% down. If you’re putting 50% down, you’re giving up a lot of the leverage that we were just talking about. You’re not multiplying your returns as much as you were with say, 25% or 10% down. You’re only multiplying your return by two and you’re not on that chart anymore. You’re not making the same rates of returns. So it’s counterintuitive, but investing in properties that are up and coming neighborhoods that maybe aren’t already super expensive and nights tends to be the best way to develop a portfolio, at least at the beginning. A lot of people, once they had a lot of properties or they’re worth a lot, they like to invest in the nicer stuff because it tends to be more stable, easier to manage and that kind of stuff. But if you have professional property management, you really don’t have to worry a lot about that.

Anthony: There’s just a little study here showing, can prices go any higher? First time investors always get challenged on how expensive LA is. And uh, I did another little study a number of years back and looked up global home prices. I couldn’t find global apartment building prices in an easy list, but home prices were there at that point in time. Our apartments were going for about 310 a foot. You saw the earlier chart regarding for about four Oh seven four Oh eight to put in 2018 we weren’t even on the top 50 of global home prices. This is what average home prices were at this point. I think this was in 2014 at the same time, Los Angeles is gross metropolitan products for our Metro area with $792 billion. That makes us the third most productive Metro area in the world. And we’re weren’t even on the top 50 of home prices. So the mismatch there, again, it’s a great reason why we look at investing right here in the LA area. It makes it look like a bargain to me when you compare it to the economy.

Anthony: So here’s kind of a sample. This is a lot to digest. So, uh, if you need deposit and review, which later you can do that. But what happens here is this is kind of what a simple, very conservative investment plan light might look like for a first time investor getting started out on their first property. So if they were to buy, say, a $500,000 property to start with 125 grand down, that’s 25% make a little bit of income, that’s 5% on your equity at the beginning. That property goes up in value and just like our leverage depreciation example, they’re going up at 20% now what happens is as this property appreciates, the equity goes up and as the equity goes up, if you remember the return on equity equation equities in the denominator, so as equity goes up faster, your return gets diluted and your return on equity goes down.

Anthony: So you can’t just buy one property with $100,000 down and expect to be worth eight point $6 million in 20 years. Like our previous example, that’s unrealistic. Instead, at some point you’re going to have to re leverage your return and you’re going to have to buy more properties either by completing what’s called a 10 31 exchange where you don’t have to pay capital gains tax and you sell your original property and buy a larger one. Or you can refinance the property that you purchased. They’d cash out on the refinance and go buy a second property. They both have the effect of really leveraging your equity. So in this example, you can see an exchange happening after four years. This property is worth 578,000 this is just average at a 5% appreciation. You’ve got 203,000 in equity in the property. We’re going to sell it and completed an exchange and buy an $812,000 property.

Anthony: 203 is 25% of 812 and look what happens after our next year, I have to be exchange. Our leverage appreciation goes back up to 20 so what you’re really trying to do is play a game of averaging the highest rate of return. You can on your money over time, which takes paying attention to what your ROI is every year and deciding to make moves when they’re appropriate. And of course we inform all of our clients, make those decisions and then execute on transactions when it’s time. It’s a lot to take in. I know there’s a few reasons why multi-families particularly perfect for this. If you’re getting started, um, it’s really easy to understand. These are apartment buildings. It’s not rocket science. Um, at the end of the day you’re in the business of housing, which is a basic human need. You’re in a business that can’t go out of business and that’s very different from other types of commercial real estate where I’ll go, you were in the real estate business, you’re really investing and you’re investing in the business of whatever your tenants. So I always like to joke about, you know, what, if you owned a retail center with a blockbuster video in a circuit city and you know, name your retailer that’s gone out of business in the last few years, you could be stuck with a giant vacancy that can last for years and be very expensive to fill. Apartment units are really simple, uh, easy to remodel, the pretty cheap to remodel. Everybody needs a place to live. Especially here in LA, we have a huge shortage. You’re never really going to have significant problems with vacancy owning these things.

Anthony: Um, it’s also perfect for first time investors because they’re really easy to estimate expenses. Uh, again, you know, you can just get utility bills, um, historical costs on repairs. You know, when your loan going to be, you can get an insurance quote while you’re in escrow. There’s very little guesswork and very, not a lot of stuff that you’re not going to know going into the transaction about how your building is gonna perform over time. It’s also really easy to figure out what your rents could be because there’s a lot of websites and stuff like that out there for, you know, renters that are looking to rent the place. And you can look on Craigslist, apartments.com lento meters. My personal favorite for rent comps, easy destiny. Also great financing. Like we mentioned earlier, you get fantastic rates on multifamily properties and you can buy with owner occupied financing. So if you’ve got a flexible living situation and you’re okay living in one of the units, you can buy with FAJ or other low money down loan programs, which can allow you to buy with an incredibly small amount of money out of pocket. And then you can turn the building over to your professional manager and you don’t really have to worry about the three T’s that everybody is afraid of. Right? Tenants, toilets and trash. Not really your problem if you have a professional manager

Kendyl: Wait, what’s the second one? Tenants.

Anthony: Tenants, toilets and trash.

Kendyl: That’s actually very, great

Anthony: yeah, there’s a saying where you don’t have to be a landlord to be a first time investor. That’s absolutely true. With good management. A lot of people think those two go hand in hand and they don’t. Here’s just some old stuff that we had laying around the office. Uh, we’ve been around since the 60s so just like to show what can happen here. These are two very similar properties. This was in the city of Lawndale and how quickly things can go up if you’re just participating, if you happen to own, here’s the new on a lot that sold in 1977 for 55,000 bucks. Basically the same property sold in 1980 and the price was 129 grand. So if you’re in, if you’re just scan and you’re participating and you’re going to take advantage when that kind of thing happens to the market, if you’re not under sitting on the sidelines, you can’t.

Anthony: Nobody’s really going to be able to predict when this is going to go on. But if your money’s in play, money’s working for you. That’s the key here. So back to Kendyl’s earlier questions about what a firs time investor needs to get started. Like we said, it’s really not that difficult to get going with apartment buildings. You can get started with a surprisingly small amount of capital, so this is kind of just a list of a few different types of people that might be a great client for us who might want to invest in their first multifamily properties here in Southern California. It’s really anybody who’s heard that real estate can be an effective tool for generating wealth, but you don’t know where to start. We can get into a lot more detail about all the concepts behind this. The analysis, I picked the right property, what different areas are going for, where you might want to look, everything about inspections, management, financing, all that kind of stuff.

Anthony: We really got a full service experience here so you don’t have to do any of that yourself. Um, if you have 150,000 or more to invest in verifiable income, so you’d be able to get approved for the loan. 150,000 is good for 25% down payment on 600 grand, which is where a lot of kind of a starter duplexes and investment properties are priced at right now in the LA area, if you have 50,000 or more to invest verifiable income and you can owner occupied, then you can, you’ve got tons of choices. You can get FHA, you can put three and a half percent of the purchase price down so you know like a million dollar apartment building. You could put only 35 grand down and you could, you could be an apartment investor, you have lots of the options. The other thing about doing these owner-occupied loans as you get great rates and if you put a low percentage down and we think about how that affects that leveraged appreciation that it can multiply your returns above 100% in your first year of ownership.

Anthony: So it’s an excellent way to start and to grow some equity as you’re just getting going as a first time investor. At the very beginning, tons of our clients start their first time investing by owner occupying their first investment purchase and then moving up from there. If, on the other hand you have capital and you have assets but you’re not currently working, uh, if you have $400,000 or more to invest, but you don’t even have any income, this would apply to people that maybe inherited a property you use for money or maybe somebody who a business or recently retired. In that case, you can get in a commercial side apartment building, which the lending world sees as five units and above. And once you’re in the five units and above space, you can get financing. It’s just based on their buildings, income alone and not your own. It’s a little bit counterintuitive that if you want to spend a lot more on an apartment building, we don’t need to know how much you make, but that’s how the lending industry, so any people in those three characteristics, um, could be a great client for us. And of course we can help people that already have gotten started on their own American wondering when this gets fun and how they can scale up, how they can get larger. We specialize in helping people do portfolio analysis and maximize their returns. And do exchanges for people that inherited property. We can help do analysis on that. Um, and really kind of feed the quarterbacks for helping you grow your empire over time.

Kendyl: That’s

Anthony: so with that, you want to avoid still going to work when you’re retired. So we always show it a little cartoon with Jerome and with that we can take any questions.

Kendyl: Yeah, that is, this is the third time that I’ve seen this presentation and I learned something new every time I go through it. Obviously, well maybe not. So obviously most people know that DIGGS is residential focused. We really haven’t gotten too much into income yet. Most of our agents are right at that place where they’re ready to start thinking about their next home, their first time investment. And I know that many of our clients are doing the same. So Anthony is down in the South Bay. Uh, we’re up here. We want to be working with Anthony to help the, help our tribe start their real estate empire. Um, and so I’ll be putting, dropping in a contact information form down below. Uh, give us your contact information. We’ll make sure that you can get in touch with Anthony, uh, so we can get that stream going, work together, and let’s grow your wealth together. Anthony, thank you so much for doing this for us. We greatly appreciate it and we look forward to doing business together with Buckingham investment fix.

Are You Ready To Be A First Time Investor?

We’ve teamed up with Anthony to provide the best possible guidance and advice for First Time Investors. Call/Text us today to find out your next steps!

Call: 818.482.1885

Text: 818.946.0106

Email: kendyl(at)GlendaleDIGGS(dotted)com

Podcast: Play in new window | Download

Subscribe: Apple Podcasts | Google Podcasts | Spotify | Stitcher | Email | TuneIn | RSS